Global Trust in Chinese Manufacturing with the Best Hydraulic Cutting Tools

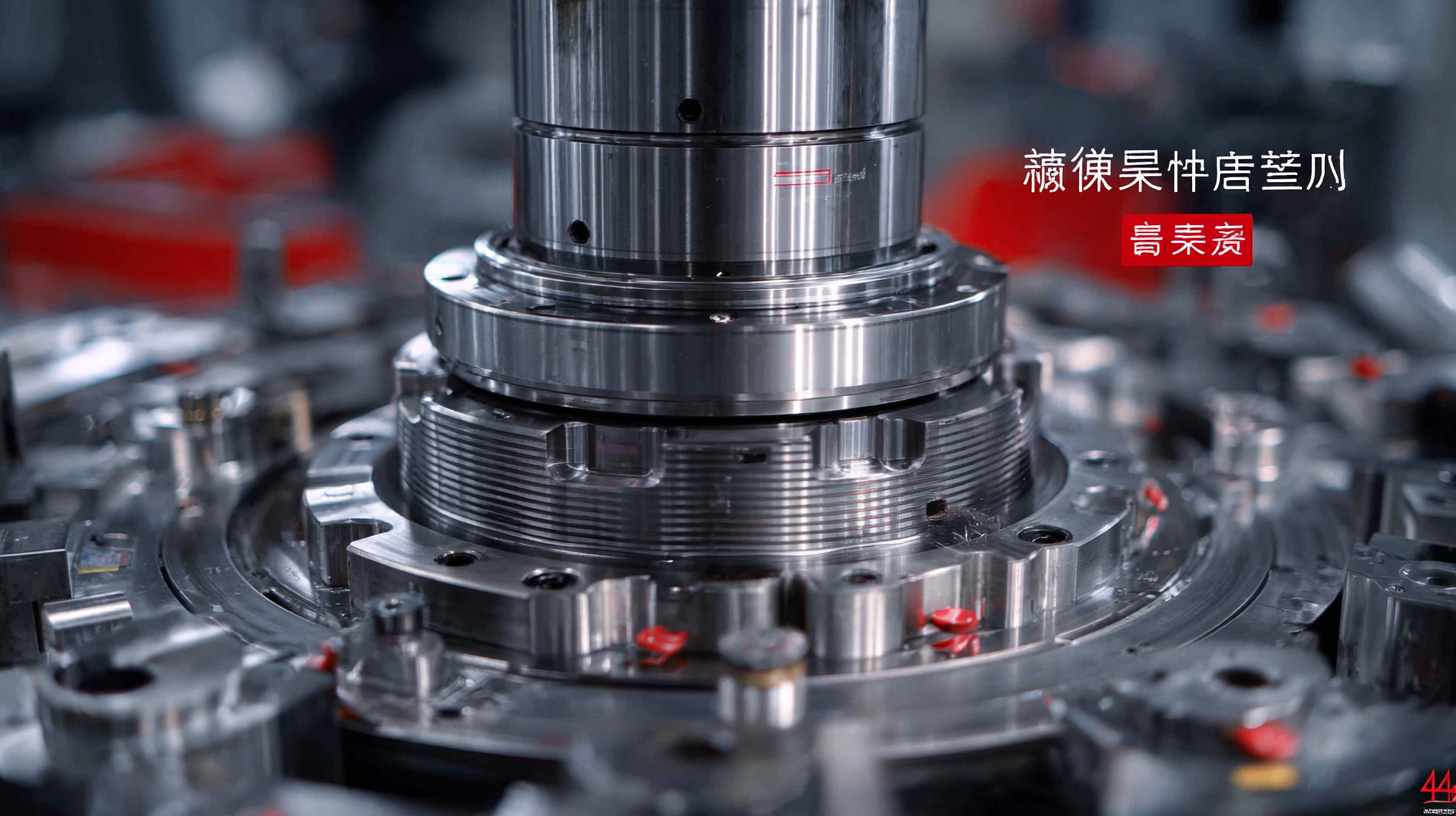

In recent years, the global manufacturing landscape has seen a notable surge in the reliance on hydraulic cutting tools, with the market valued at approximately USD 8.7 billion in 2022, projected to reach USD 12.2 billion by 2028, growing at a CAGR of 6.5% (MarketsandMarkets). This growth is fueled by the increasing demand for precision and efficiency in various industries, ranging from automotive to aerospace. Chinese manufacturers have emerged as key players in this sector, providing high-quality hydraulic cutting tools that meet international standards. Their ability to combine innovative technology with competitive pricing has bolstered global trust in their products, making them a preferred choice for manufacturers seeking reliable solutions. As companies worldwide strive to enhance productivity and reduce operational costs, understanding the capabilities and advancements in hydraulic cutting tools from China is essential for staying ahead in the competitive market.

The Rise of Global Trust in Chinese Manufacturing and Its Impact on Hydraulic Tools

The rise of global trust in Chinese manufacturing is no longer just a trend; it's a movement that is reshaping the landscape of hydraulic tools. As industries worldwide recognize the quality and innovation coming out of China, the demand for advanced hydraulic cutting tools has surged. A report indicates that the Chinese electric tool market is projected to grow from $5.56 billion in 2025 to $8.29 billion by 2032, showcasing a compound annual growth rate (CAGR) of 5.8% during this period. This substantial growth reflects the increasing reliance on Chinese-manufactured tools in various sectors, driven by their cost-effectiveness and technological advancements.

Moreover, as global markets embrace these tools, manufacturers in China are investing heavily in quality assurance and research and development. This commitment not only enhances their competitiveness but also fosters trust among international clients. The impact of this shift is evident, as companies worldwide are now more willing to source hydraulic tools from China, recognizing the balance of quality and affordability these products offer. As trust in Chinese manufacturing continues to rise, we can anticipate significant transformations within the global hydraulic tools market.

Assessing After-Sales Service Advantages in the Competitive Market

In the competitive landscape of manufacturing, after-sales service emerges as a critical factor that can differentiate leading brands in the hydraulic cutting tools market. According to a 2021 study by MarketsandMarkets, after-sales services can boost customer satisfaction by up to 25%, which not only enhances brand loyalty but also leads to increased repeat business. Companies that invest in robust after-sales support systems ensure that customers receive timely maintenance and expert guidance, thereby diminishing downtime in their operational processes.

Moreover, a report from Mordor Intelligence indicates that the global demand for hydraulic cutting tools is projected to grow at a CAGR of 6.5% from 2022 to 2027, underscoring the necessity for reliable and efficient after-sales services. Chinese manufacturers, often seen as leaders in production capabilities, are increasingly focusing on enhancing their service models. By offering comprehensive training programs and readily available spare parts, they not only improve operational efficiency for their clients but also carve out a niche in the eyes of global consumers who prioritize quality service. Such strategic service enhancements serve as vital components in building lasting trust in their products across international markets.

Cost Analysis: Maintenance and Repair Expenses for Hydraulic Cutting Tools

When it comes to hydraulic cutting tools, understanding the cost associated with maintenance and repair is crucial for manufacturers seeking longevity and efficiency in their operations. Investing in high-quality Chinese manufacturing can yield superior cutting tools that not only perform exceptionally but also come with manageable maintenance expenses. Regular maintenance, such as lubrication, blade sharpening, and routine inspections, can significantly prolong the lifespan of these tools, ultimately reducing overall operational costs.

Analyzing repair expenses reveals that issues can often be mitigated with proper care. For instance, addressing minor wear and tear immediately can prevent more significant and costly repairs down the line. Chinese manufacturers typically provide robust warranties and support services, ensuring that any necessary repairs do not disrupt production schedules or lead to hefty downtime costs. In an era where efficiency and cost-effectiveness are paramount, choosing reliable hydraulic cutting tools from reputable manufacturers not only enhances productivity but also safeguards against unexpected maintenance expenditures.

Global Trust in Chinese Manufacturing with the Best Hydraulic Cutting Tools - Cost Analysis: Maintenance and Repair Expenses for Hydraulic Cutting Tools

| Tool Type | Average Purchase Cost ($) | Annual Maintenance Cost ($) | Average Repair Cost ($) | Lifespan (Years) |

|---|---|---|---|---|

| Hydraulic Shears | 1500 | 200 | 300 | 5 |

| Hydraulic Press | 3500 | 400 | 600 | 7 |

| Hydraulic Pipe Cutter | 800 | 150 | 200 | 4 |

| Hydraulic Angle Cutter | 1000 | 180 | 250 | 6 |

| Hydraulic Cable Cutter | 900 | 130 | 220 | 5 |

Forecasting Innovations: The Future of Hydraulic Tool Technology

The hydraulic tool industry is on the brink of significant innovations that promise to reshape manufacturing processes globally. According to a recent report by MarketsandMarkets, the hydraulic tools market is projected to reach $8.1 billion by 2025, growing at a compound annual growth rate (CAGR) of 5.2%. This growth is driven by increasing demand for efficient and precise cutting tools across various industries, including construction, automotive, and aerospace. As manufacturers seek to enhance productivity and reduce energy consumption, advancements in hydraulic technology are essential for achieving these goals.

In addition to efficiency, sustainability will play a crucial role in the future of hydraulic tool technology. The rise of eco-friendly manufacturing practices is pushing companies to innovate and integrate environmentally conscious designs into their products. Research from TechNavio indicates that the demand for lightweight and energy-efficient hydraulic cutting tools is expected to rise, with innovations such as smart technology and IoT integration facilitating real-time performance monitoring and predictive maintenance. This shift not only enhances operational efficiency but also aligns with global environmental standards, making the hydraulic tools of the future not just powerful but also sustainable.

Market Trends: Understanding Global Demands for High-Performance Hydraulic Equipment

The global hydraulic seals market is witnessing a significant expansion, with its size valued at approximately USD 4,598.0 million in 2023. This growth trajectory is expected to propel the market further, as projections suggest it will reach USD 4,804.9 million by 2024 and soar to about USD 6,833.1 million by 2030. The increasing demand for high-performance hydraulic equipment across various industries is driving these trends, particularly in sectors such as construction, manufacturing, and automotive, where hydraulic systems are essential for operational efficiency and reliability.

To adapt to these evolving market demands, manufacturers must focus on improving the performance and sustainability of their hydraulic cutting tools. Implementing advanced sealing technologies can significantly enhance the longevity and effectiveness of hydraulic equipment.

Tip: Regularly assess the hydraulic systems in use to ensure they are equipped with high-quality seals that can withstand pressure and temperature variations.

Investing in research and development to innovate and refine hydraulic solutions will allow manufacturers to stay competitive in a rapidly changing landscape.

Tip: Collaborate with industry experts to better understand emerging technologies and trends that can influence the performance of hydraulic tools, ensuring you meet global standards and customer expectations effectively.